To many of us, the stock market can be daunting (to say the very least). We know that investing is something we probably should—and want to—be doing, but the obstacles to starting it can turn it into something we put off over and over again.

Sponsored by Equilibria /

Looking for Better Sleep? This Super Ingredient Might Be the Answer

don’t fret, exhausted readers 💤

I’ve always been in that exact boat. Even though I’m surrounded by people who know the ins and outs of investing, I’ve always felt like I didn’t even know what I didn’t know about how to start investing, like the barrier to entry was held by someone who never gave me the knowledge to know where to begin. But with the right tools, you don’t need to feel that way.

Enter: Public. Public is the social network for investing, and their mission is to make investing approachable for all people. They make the stock market both inclusive and educational, and through social features, they make it easy to build your confidence as an investor. There’s no barrier to entry or prior knowledge necessary; it’s meant for investors at all levels, including beginners. They know that a significant reason why many don’t invest is because of a lack of financial literacy, so they aim to unlock the stock market to a wider range of people through the empowerment of a community where you can learn and grow.

We turned to the experienced investors at Public to ask them all of the questions that we had as first-time investors, from the complicated definitions to figuring out if it’s even a good time for you to be investing anyway. Thinking of investing for the first time? We’ve got you covered, no jargon included.

*The following is for educational purposes only and is not investment advice.

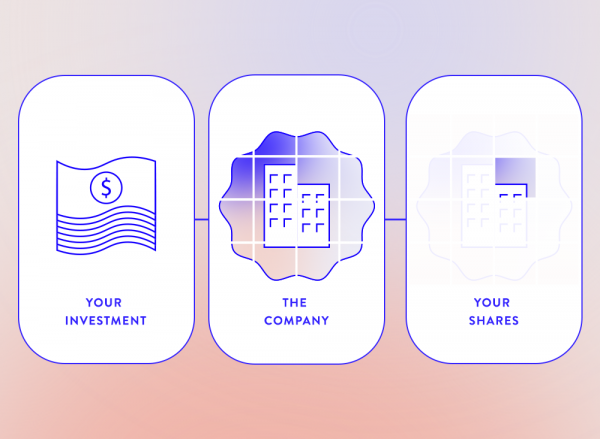

1. Let’s start at the beginning: What is the stock market, a stock, and an investment, and how do the three work together?

An investment is an allocation of money directed with the goal of generating a positive return over time. To invest in a stock is to own a share of a particular company and therefore a portion of the company’s assets and profits. Stocks are most commonly traded on public stock markets, where companies list shares on exchanges like the New York Stock Exchange or the Nasdaq. Historically, the U.S. stock market has trended upwards over time, about 9 percent annually on average*, which is why many investors buy and sell shares of publicly traded companies as part of a long-term investment strategy. It’s important to note that not every individual stock has an upward trajectory over time, which is why diversification—that is, spreading risk across companies at different stages of growth and in different industries—is a popular strategy among investors.

2. What are bull and bear markets?

A bull market is defined as a point in time when the market is doing well and growing at a steady pace. During this time, investor sentiment is optimistic and stock prices rise significantly following a previous decline. The opposite of a bull market is a bear market, which is when the market is seeing challenges and investor sentiment is on the decline.

3. What exactly is a broker?

A broker is a person or firm who executes transactions between a buyer and a seller on the public markets. Someone looking to invest in securities like stocks or bonds typically opens a brokerage account with a brokerage firm and deposits money into their account to fund their investments. There are many different types of brokerage firms available to investors, and setting up an account is the first step toward building an investment portfolio.

4. What are compounding returns?

A compound return takes into account compound interest, which is the amount of money someone accrues on their principal investment over time. It’s usually expressed in annual terms and can also be referred to as a Compound Annual Growth Rate (CAGR). Since returns on the original investment compound over time, many advisers recommend investing early and consistently. If you ever heard the phrase “Time in the market beats timing the market,” that’s referring to the power of compounding over time.

5. When I invest in the stock market, how does my investment grow?

While individual stocks rise and fall daily, the stock market as a whole has historically risen in value over time. Since its inception, the U.S. stock market has historically returned profits to its investors, with an average annual return rate of about 9 to 10 percent* (pre-inflation). Importantly, this is not to say that every individual stock goes up over time at this rate. Some stocks grow in value at a sharper degree, while other stocks sink in value. Diversification is important as it allows you to spread risk across many investments. New investors will often start with index funds or ETFs (exchange-traded funds), which are innately diversified and tend to ride the general trends of the market overall.

6. Can you explain the concept of “buy low, sell high?”

When one buys stocks or securities at a low price and sells them at a higher price, they make a profit on the difference. This strategy relies on trying to time the market and is often difficult to do.

7. What is volatility, and why does it matter?

Market volatility is a measure of the changes in value that a market experiences over a certain period of time, and it is normally characterized by rapid change and unpredictability. It can be caused by many things, including economic factors, news, interest rate changes, fiscal policy, and more. Volatility is significant because it serves as a reflection of investor sentiment and is largely an indicator of the overall health of the market. Keeping a pulse on it is essential when deciding how to manage one’s investment portfolio.

8. When is the right time to sell a stock? How frequently should I be selling my stocks?

Knowing when to sell is one of the hardest parts of investing, as it’s difficult to predict when a stock will start decreasing in value. Because of this unpredictability, staying informed and on top of market news and events is important when creating a successful investment portfolio. Many investors will set a price target or projected future stock price as a benchmark for selling an investment and will periodically calculate gains and losses to monitor the performance of short-term investments. While some investors might quit while they’re ahead and sell the stock, others might hold onto it in hopes that it will continue to grow in value.

9. Let’s debunk some investing myths: Is there really a “right time” to start investing?

The popular answer among investors is that “it’s always the right time to invest,” and many advisers say that time in the market is more important than timing the market. Many advisers recommend investing as early as possible, given the power of compound interest and its growth over time.

10. How much money do I need to have to begin investing?

Public.com is a great option for investors who are looking to build their confidence within a community of other investors. This investing app is special because it includes social features that allow you to share why you made an investment and ask questions about other people’s investments. The app is also expanding provide to financial education, with features like Town Hall that allow retail investors to pose questions to CEOs and founders from companies like Lemonade, Bumble, and DraftKings. Public Live is a new feature that allows investors to listen in as credible journalists break down what’s happening in the markets in an accessible way. Learning in the context of real-world situations makes financial concepts easier to grasp. On Public, investors can own fractional shares of more than 4,000 publicly-traded companies and ETFs with no commission fees on standard trades.

11. If what I choose to invest in isn’t doing well, should I pull my money out?

You only lose money on stock market investments when you sell. This is an important concept for new investors. Say you own one share of Company X at $50/share. The company has a down quarter in sales, which moves the stock price down to $35. You would still own one share of the company in this case, so if the company can recover and go back up, you would not lose the value of that share.

Knowing when to sell will depend on the individual. At a high-level, many investors choose to sell when they stop believing in the future growth of the company. There are several signs that could indicate this, including significant changes in the business or consistent losses, as revealed by quarterly earnings reports. However, panic-selling an otherwise strong stock because of a short-term drop is not typically regarded as a strategy for long-term success in the markets. Money is inherently emotional, but it’s important to keep a cool head when investing and stick to your own research and judgment instead of making reactive moves based on fear.

Source: Social Squares

Terms to Know

The Basics

- Stock: A stock, also known as an equity, is a share of ownership in a company. Stocks are sold at the price of each share, which varies from company to company.

- Stock option: Stock options are contracts that give someone the right but not the obligation to buy or sell a stock at a predetermined price.

- Stock market: A collection of exchanges where companies list shares and investors buy and sell them.

- Trading: The buying and selling of financial instruments such as stocks.

- Stockholder: An individual or institution that owns one or more shares of a company.

- Portfolio: A collection of investments in various companies.

- Broker: A person or firm who executes transactions between a buyer and a seller on the public markets.

- Market value: The price at which a share would trade at on the public markets.

- Appreciation: An increase in the price or value of assets. On the public stock market, appreciation refers to an increase in the value of company stocks held by an investor.

- Dividends: A dividend is the payment of cash or additional stock to a company’s shareholders. They are not required, and as a product of the company’s excess profits, they are often viewed as a sign of financial health. A company’s board of directors can decide to issue, cut back on, or eliminate dividends at any time.

- Compounding returns: A compound return takes into account compound interest, which is the amount of money someone accrues on their principal investment over time. It’s usually expressed in annual terms and can also be referred to as a compound annual growth rate (CAGR). Since returns on the original investment compound over time, many advisers recommend investing early and consistently.

- Compound annual growth: The compound annual growth rate is a measurement indicating the returns on an investment on an annually compounded basis. It’s one of the most accurate ways to determine returns on investments.

- Internal rate of return (IRR): The average rate of return an investment in a company is expected to generate. Investments with higher IRRs are generally considered the most desirable.

- Capital gains tax: A type of government tax applied to the profit made by selling an investment. The IRS taxes long-term capital gains (made on the selling of assets held for more than a year) differently than it taxes short-term capital gains.

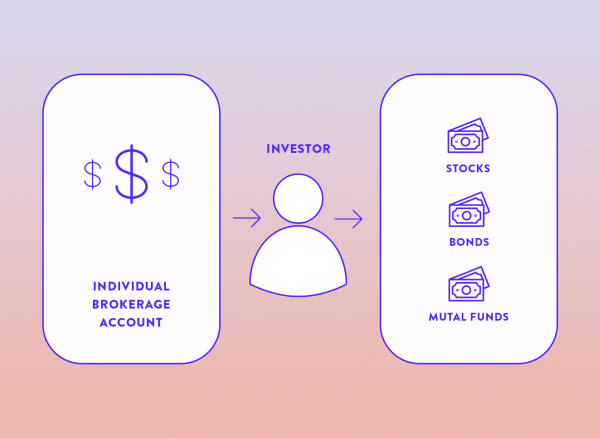

Accounts and Funds

- Individual brokerage account: An account that holds financial assets on behalf of an investor. The funds in a brokerage account are what investors use to buy and sell securities like stocks, bonds, and mutual funds.

- Mutual fund: A mutual fund is a professionally managed investment that pools money from a group of investors to purchase stocks, bonds, or other assets with the goal of creating a highly diversified portfolio. When one invests in a mutual fund, a professional fund manager owns the buying of securities. While mutual funds have many benefits associated with diversification and time savings, they also have many drawbacks, including fees and tax inefficiency.

- ETF: An exchange-traded fund (ETF) is a bundle of several investments sold as a package. Similar to a stock and unlike mutual funds, they are sold throughout the day and for a share price. They can be designed according to market sector, geographic region, type of security, and more.

- Index fund: A portfolio of stocks and bonds designed to mimic the performance of a financial market index such as the Dow Jones Industrial Average or the S&P 500. These funds have lower expenses and fees than actively managed funds and follow a passive investment strategy.

Stocks and Shares

- Security: A tradable financial asset that represents some type of financial value. Examples of securities include stocks and bonds.

- Fractional share: A portion of a stock that is less than one whole share. Fractional shares allow investors to purchase stocks based on a dollar amount rather than the price of a whole share. Fractional share owners hold a portion of a full share of stock, which allows people to start investing in smaller increments and build positions in companies whose stock price may be cost-prohibitive to them. For example, a single share of Amazon stock currently trades at more than $3,000 per share. Before fractional, an investor would need to have $3,000+ for the full share to invest in Amazon. With fractional, investors can put $5, $10, or $50 toward an Amazon investment and build over time.

- Common stock: The most common stock bought. Each share bought is equal to a single vote at a shareholder meeting. Common stocks often, but not always, entitle their owner to a portion of the company’s profits, which is known as a dividend.

- Blue-chip stocks: These are stocks issued by reputable companies with name recognition that experience consistent growth and provide a reliable return to investors. Many of these stocks also pay dividends. Examples include Apple, Sony, Disney, and General Electric.

- Small-cap stocks: These stocks are companies that have a market value ranging from $300 million to $2 billion. The company may be at the start of its lifespan, serve a niche sector, or exist within a developing arena. They are said to be riskier investments because of their age, size, and the industries they serve.

Company Terms

- Market capitalization (market cap): Market capitalization is the total value of a company. It’s determined by multiplying the current market price of one share of the company by the number of total outstanding shares.

- Stock split: Stock splits are a type of corporate action in which the company’s executives increase the number of shares, giving existing shareholders more stocks proportionate to the split ratio. The price per stock then decreases proportionate to the split ratio. Companies split stocks in order to increase stock liquidity and invite smaller investors. It can affect market demand, but it does not change the company’s value.

- Annual 10-K filings: These are comprehensive reports filed annually by public companies. They are required by the U.S Securities and Exchange Commission (SEC) and disclose information about the company’s financial performance.

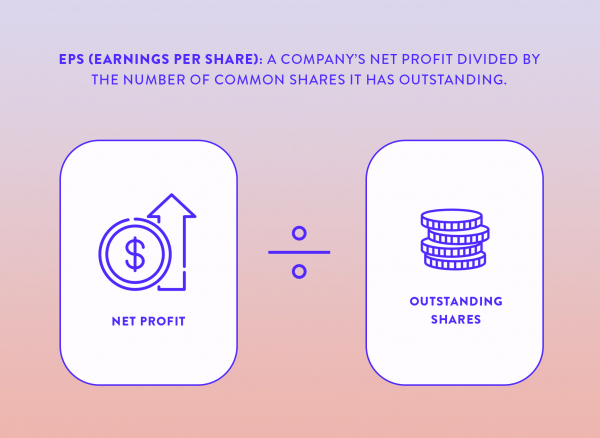

- Quarterly earnings reports: Quarterly filings made by public companies that disclose financial information relevant to shareholders and potential shareholders, including info about income, net sales, and earnings per share. Following the release of an earnings report, companies will hold earnings calls where investors and analysts can ask questions. These calls are open to the public and a great opportunity to do research on a company you may invest in or want to learn more about.

- EPS: EPS stands for earnings per share, which is a company’s net profit divided by the number of common shares it has outstanding.

- Gross margin: A company’s net sales revenue minus the cost of goods sold.

- Profit and Loss (P/L): Profit and loss (P&L) statements are financial reports made by companies that summarize their revenues, costs, and expenses during a specified period and indicate their ability to generate profit.

- Price to earnings ratio (P/E): A measure of the company’s stock price relative to their earnings per share. This ratio is used to help determine whether companies are over or undervalued.

- Debt to equity ratio (D/E): A financial measurement that is used to analyze the amount of debt a company holds compared to its shareholder equity. A relatively high debt-to-equity ratio tells an investor that the company relies heavily on debt to finance operations and expansion, while a low debt-to-equity ratio tells an investor that the company does not rely on borrowing a lot of money to finance operational activity.

- Return on equity (ROE): Considered the return on a company’s net assets, ROE is a measure of a company’s profitability in relation to stockholder’s equity. It’s calculated by dividing net income by stockholders’ equity.

- Dividend payout ratio: This equals the percentage of a company’s earnings paid to shareholders in dividends.

Strategies

- Buy-and-hold: This is a passive investment strategy in which an investor buys a type of securities (such as stocks) and holds them for an extended period of time, regardless of fluctuations in the market.

- Short a stock: In this situation, an investor borrows a stock, sells the stock, and then buys it back to return it to the lender. The seller is betting that the stock they sell will drop in price, and the profit they make is the difference between the sell price and the buy price.

- Risk tolerance: How much risk one is willing or able to take on as an investor. Someone with little financial wiggle room generally has low risk tolerance vs. someone with more disposable income and/or more years until retirement.

- Diversified investments: Diversification is the process of spreading risk across investments with varying degrees of risk, for example across companies at different stages of growth (large cap vs. small cap) and in different sectors (e.g. commodities vs. technology). When someone diversifies their investment portfolio, they spread their money out across a variety of companies and assets (like stocks, bonds, and commodities) in order to reduce risk while earning the highest possible return. Diversification helps investors weather challenges that a certain segment of industries may be facing. For example, during the COVID-19 pandemic, travel stocks were hit hard, but tech stocks powering remote work, like Zoom, soared.

Options

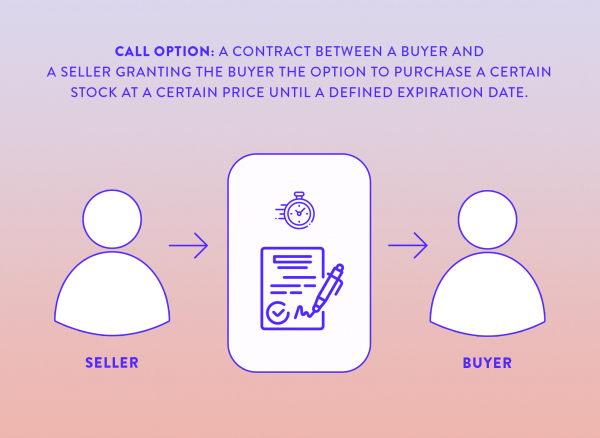

- Call option: A contract between a buyer and a seller granting the buyer the option to purchase a certain stock at a certain price until a defined expiration date.

- Long call: A call option that bets on the underlying stock increasing in value prior to its expiration date.

- Long put: A strategy used when an investor expects the underlying stock price to decrease.

- Put option: The opposite of a call option, a put option is a contract giving the stock owner the option to sell a certain stock at a certain price within a specified time frame.

- Covered call: A financial transaction in which the investor selling call options owns an equal amount of the underlying stock.

The Stock Market Exchange

- Initial public offering (IPO): An initial public offering or stock market launch is the first time a company sells stocks to the public. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges.

- Forex: Otherwise known as the foreign exchange, this is the conversion of one currency to another. The foreign exchange market is a decentralized place for the trading of currencies, and it determines foreign exchange rates for every currency.

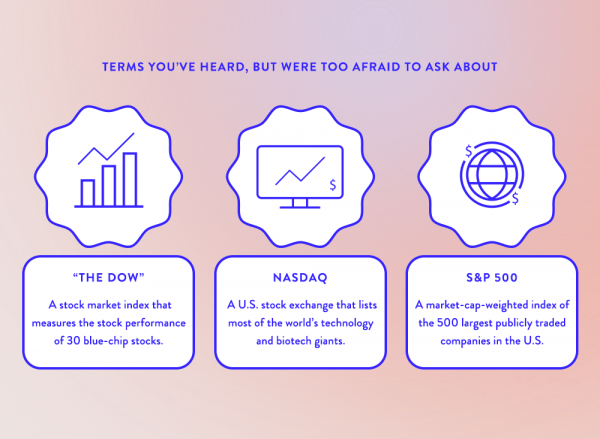

- Dow: The Dow Jones Industrial Average is a stock market index that measures the stock performance of 30 blue-chip stocks listed on exchanges in the United States. It’s a price-weighted index, which means that stocks with higher share prices carry heavier weight than lower-priced shares.

- Nasdaq: The Nasdaq is a U.S. stock exchange that lists most of the world’s technology and biotech giants, including Apple, Amazon, and Google. The term also refers to the Nasdaq Composite, an index of the stocks that are listed on the Nasdaq exchange.

- S&P 500: The S&P 500 or Standard & Poor’s 500 Index is a market-cap-weighted index of the 500 largest publicly traded companies in the U.S.

*Offer valid for U.S. residents 18+ and subject to account approval. There may be other fees associated with trading. See more at Public.com/disclosures

*Source: Rule of Thumb For Average Stock Market Return

How To Invest When You’re Living Paycheck To Paycheck

READ MORE

11 Questions All First-Time Investors Have, Answered

READ MORE

This post is sponsored by Public.com, but all of the opinions within are those of The Everygirl editorial board.